38+ 20 year fixed rate mortgage calculator

Your total interest on a 250000 mortgage. Guaranteed Rates 30-Year Mortgage.

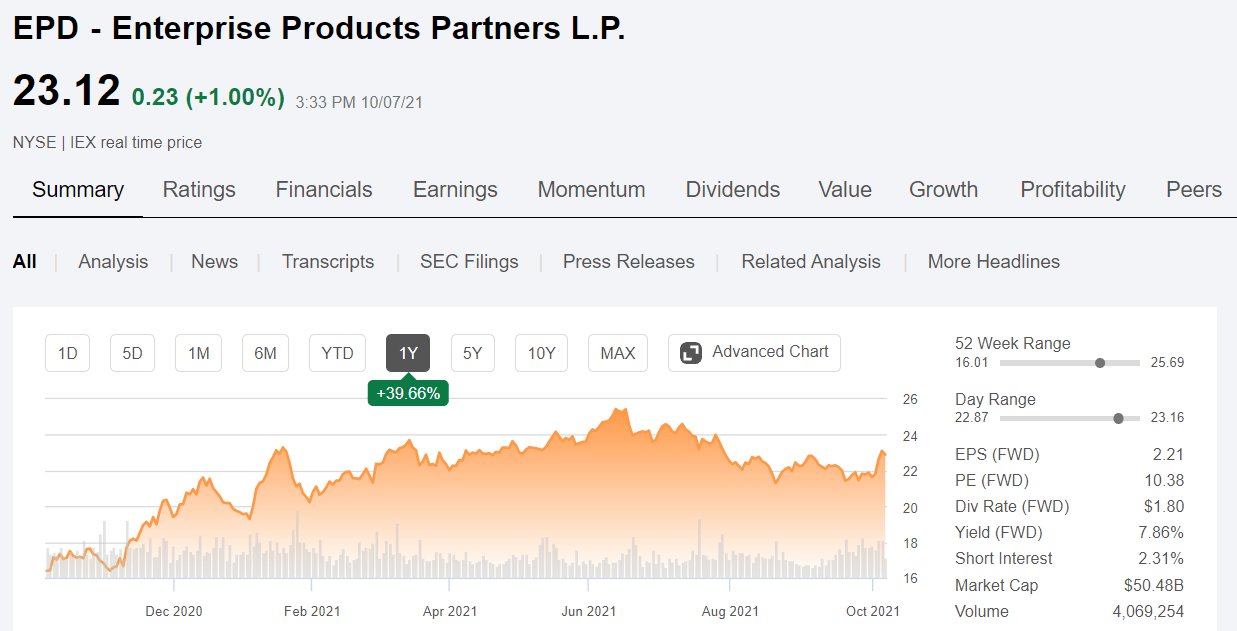

Enterprise Products Partners Stock Compelling Value Nyse Epd Seeking Alpha

The big advantage of a 30-year home loan over a 20-year loan is a lower monthly payment.

. The annual volume of HECM loans topped 112000 representing a 1300 increase in six years. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. It is the second most purchased type of mortgage product next to 30-year fixed-rate loans.

Use SmartAssets free Florida mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Here are some of the advantages of a 20-year mortgage over. A fixed rate makes it easier to budget for payments.

As for 30-year fixed-rate mortgages Urban Institute reported that it. The Higher Value 4 year fixed LTV interest rate is available to new AIB PDH mortgage customers including Switchers borrowing at least 250000 over a term of 4 years or more. Of course talking to a trusted loan officer about your financial situation and inputting relevant information into a reliable mortgage calculator is the best way to compare the pros and cons of a 106 ARM vs a 15-year fixed-rate mortgage.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 2515 monthly payment. With our mortgage calculator its easy to find out how much you could borrow. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

However for those who can afford the slightly higher payment associated with a 20-year mortgage are getting a better deal in almost every possible way. A 30-year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the course of the loan. 71 ARM refi.

What is a 30-year fixed rate mortgage. Our Closing Costs Study assumed a 30-year fixed-rate mortgage with a 20 down payment on. You can also use the calculator on top to estimate extra payments you make once a year.

For such individuals a 15-year fixed-rate mortgage may be very appealing. Advantages of a 20-Year Fixed-Rate Home Loan. The HECM reverse mortgage offers fixed and adjustable interest rates.

But borrowers can also take 10-year 20-year and 25-year terms. Thats about two-thirds of what you borrowed in interest. The 30-year fixed-rate mortgage started off the decade at about 73 percent in 1971 according to Freddie Mac.

If your downpayment is less than 20 percent of the homes value you must factor in private mortgage insurance PMI in your expenses. When a 106 ARM makes sense. Green 5 Year LTV Fixed.

30-Year Fixed Mortgage Principal Loan Amount. Because of this many consumers find fixed-rate mortgage options more attractive. For fixed-rate reverse mortgages the IIR can never change.

By the end of 1979 in a time of heightening inflation that rate rose to 129 percent. According to the Bank of England since 2016 fixed-rate options are more preferred by borrowers especially first-time homebuyers. The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. Assuming you have a 20 down payment 140000 your total mortgage on a 700000 home would be 560000. Disadvantages of 30-year fixed-rate mortgage.

Across the United States 88 of home buyers finance their purchases with a mortgage. Our Annual Percentage Rate Charges include valuation fees of 150 and 65 and a 60 security release fee at the end of the mortgage term. This data is based on Housing Finance at a Glance.

You must save adequate funds to cover monthly mortgage payments. A fixed rate mortgage has a rate of interest which doesnt change for a set period of time so you know exactly how much you pay every month. A Monthly Chartbook released in June 2020.

Conventional loans are commonly offered in 15 and 30-year fixed rate loans. The average fixed-rate mortgage was priced at 191. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

Rate or IIR is the actual note rate at which interest accrues on the outstanding loan balance on an annual basis. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

The interest rate charged on the outstanding principal balance does not change month to. 15 yr jumbo fixed mtg refi. Find average mortgage rates for the 30 year fha fixed mortgage from Mortgage News Daily and the Mortgage Bankers Associations rate surveys.

In the third quarter of 2020 912 of all mortgages used fixed-rate loans.

38 Creative Patio Garden Floor Decorating Ideas With Patterns For 2022 Landscaping With Rocks Garden Floor River Rock Landscaping

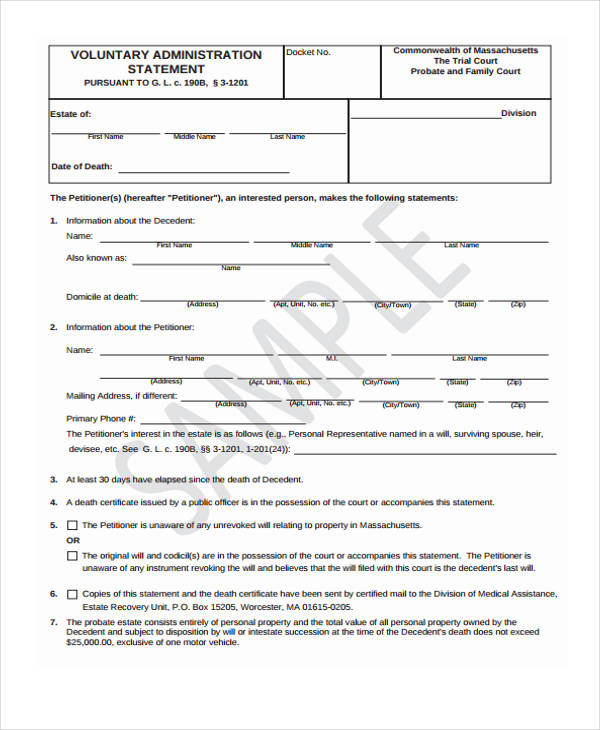

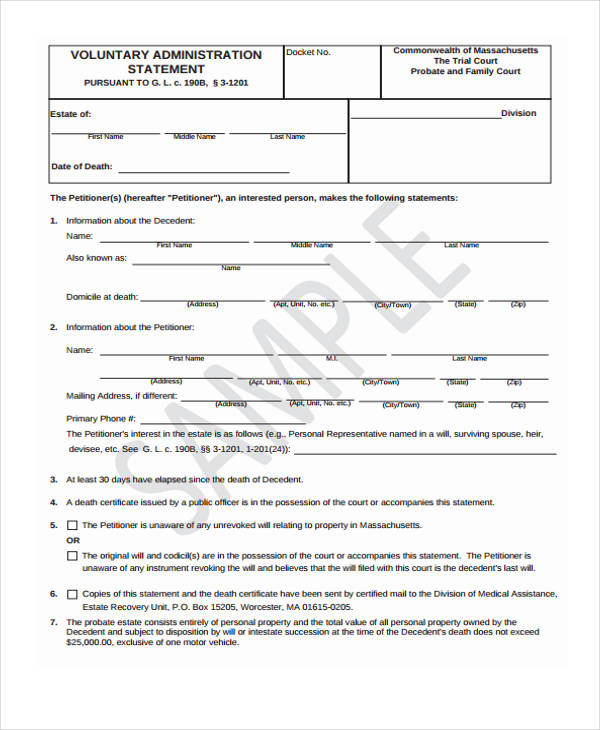

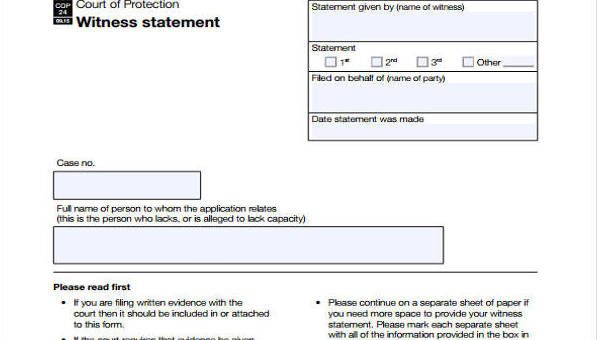

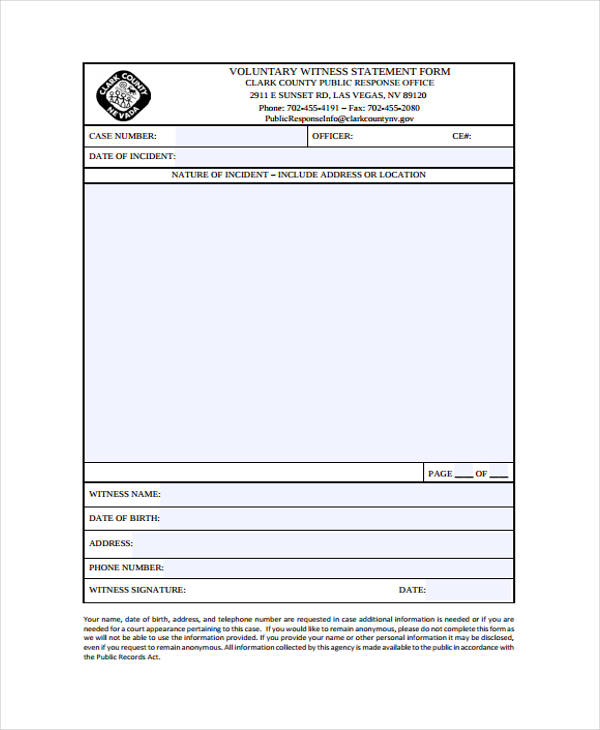

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

Free 38 Sheet Samples Templates In Pdf

Free 38 Samples Of Statement Templates In Pdf Ms Word

Pin By Mikayla Shaffer On Home Beautiful Bathrooms Bathrooms Luxury Dream Bathrooms

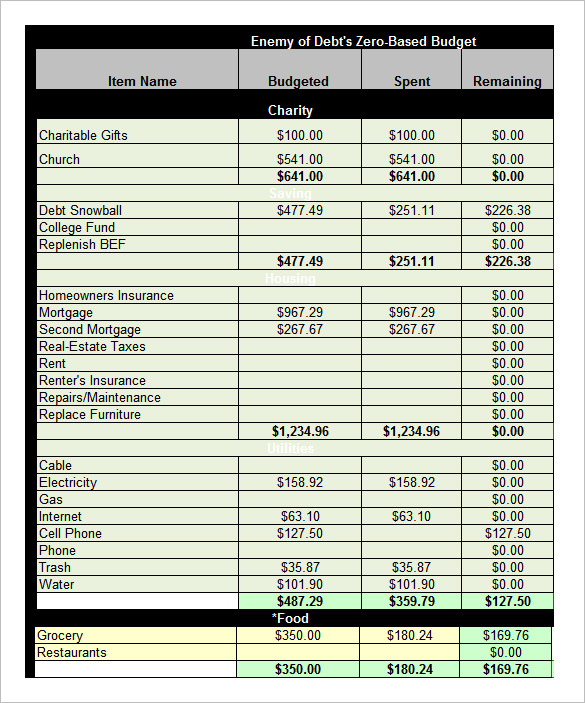

Excel Budget Template 30 Free Excel Documents Download Free Premium Templates

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

G64421mmi016 Jpg

Free 10 Balance Sheet Samples Templates In Ms Word Ms Excel Pdf

How To Make Lava Stone Driveway Rockmolds Com Garden Floor Patio Garden Design Diy Backyard Patio

Sample Eviction Notice Template 37 Free Documents In Pdf Word Letter Templates Eviction Notice Words

Free 10 Balance Sheet Samples Templates In Ms Word Ms Excel Pdf

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

Free 38 Samples Of Statement Templates In Pdf Ms Word

G64421mmi057 Jpg

Px4v4q8tcy Nxm

Free 9 Loan Spreadsheet Samples And Templates In Excel